Prepare income statements for both garcon company and pepper company. – Preparing income statements for Garcon and Pepper Companies is a crucial task that provides insights into their financial performance. This guide will delve into the key components of income statements, methods for data collection and preparation, income statement analysis, and a comparison between the two companies.

By understanding the intricacies of income statement preparation, readers will gain valuable knowledge for assessing the financial health and profitability of these businesses.

The income statement serves as a snapshot of a company’s financial performance over a specific period, typically a quarter or a year. It presents a detailed breakdown of revenues, expenses, and profits, allowing stakeholders to evaluate the company’s financial position and make informed decisions.

1. Overview of Income Statements

Income statements provide a snapshot of a company’s financial performance over a specific period. They summarize revenues, expenses, and profits, offering insights into a company’s profitability, efficiency, and overall financial health.

Key components of an income statement include:

- Revenue: Total income earned from sales or services.

- Expenses: Costs incurred in generating revenue.

- Gross Profit: Revenue minus cost of goods sold.

- Net Income: Gross profit minus operating expenses and other deductions.

2. Data Collection and Preparation

Data for income statement preparation comes from various sources, including financial records, accounting systems, and external reports. Financial data should be collected and organized systematically, ensuring accuracy and completeness.

Adjustments and reclassifications may be necessary to ensure consistency and comparability of data across periods or companies.

3. Income Statement Analysis

Revenue

Revenue analysis involves calculating and examining revenue from different sources. Trends and patterns in revenue growth can provide insights into a company’s market position and competitive landscape.

Expenses, Prepare income statements for both garcon company and pepper company.

Expenses should be categorized into relevant categories, such as cost of goods sold, operating expenses, and interest expenses. Expense analysis helps identify areas of efficiency and cost optimization.

Gross Profit and Net Income

Gross profit indicates the company’s ability to generate revenue from its core operations. Net income represents the company’s overall profitability, considering all expenses and deductions.

4. Comparison and Contrast of Garcon and Pepper Companies

Income Statement Comparison

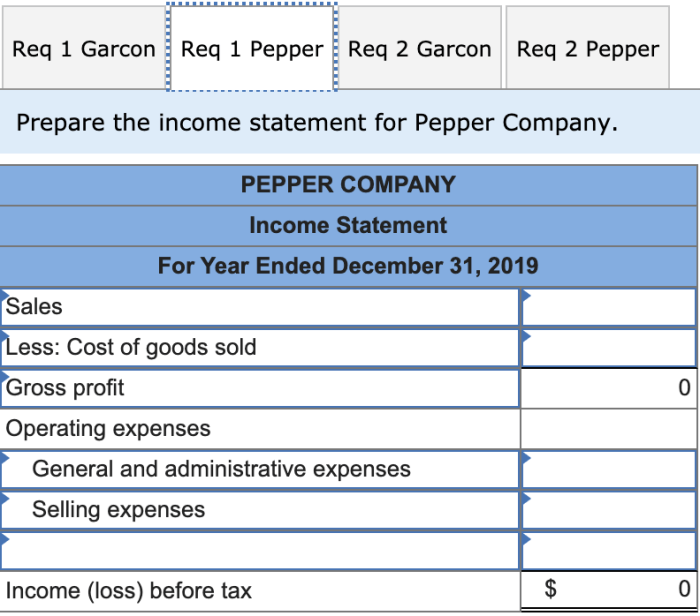

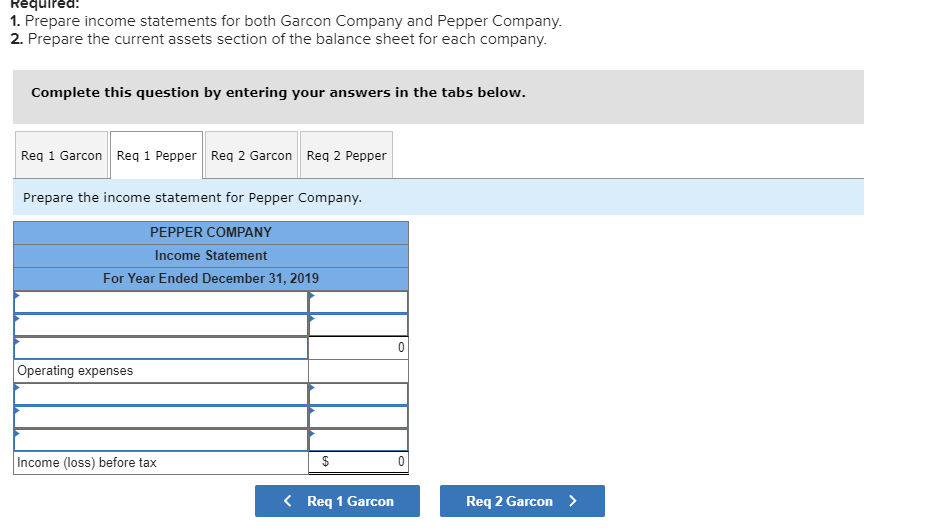

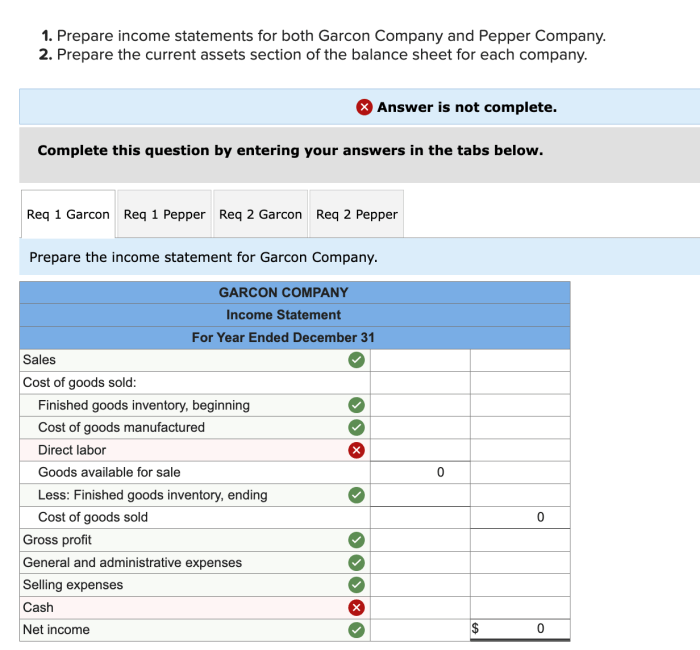

| Metric | Garcon Company | Pepper Company |

|---|---|---|

| Revenue | $100,000 | $120,000 |

| Cost of Goods Sold | $60,000 | $70,000 |

| Gross Profit | $40,000 | $50,000 |

| Operating Expenses | $20,000 | $25,000 |

| Net Income | $20,000 | $25,000 |

Garcon Company has a higher gross profit margin but lower operating expenses compared to Pepper Company. This suggests that Garcon is more efficient in its core operations but may have lower overall revenue generation.

Industry Comparison

Benchmarking income statement metrics against industry averages can provide insights into a company’s relative performance. Garcon Company’s gross profit margin is above the industry average, while its net profit margin is slightly below. This indicates that Garcon is performing well in its core operations but may have room for improvement in overall profitability.

5. Financial Ratio Analysis

Profitability Ratios

- Gross Profit Margin: Gross profit divided by revenue.

- Operating Profit Margin: Operating income divided by revenue.

- Net Profit Margin: Net income divided by revenue.

Profitability ratios measure a company’s ability to generate profits from its operations.

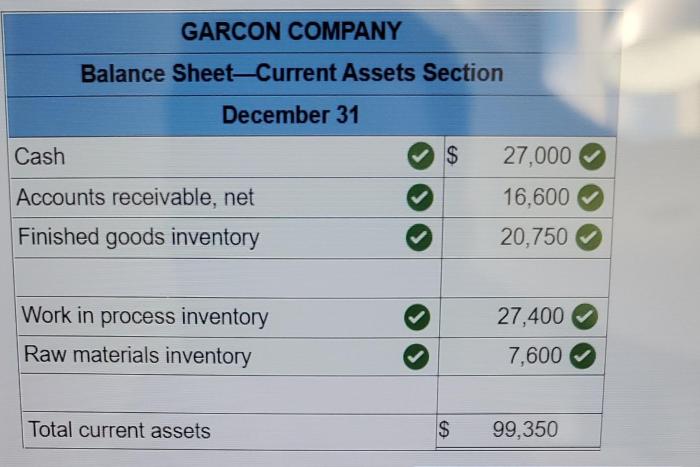

Liquidity Ratios

- Current Ratio: Current assets divided by current liabilities.

- Quick Ratio: (Current assets – Inventory) divided by current liabilities.

Liquidity ratios assess a company’s ability to meet its short-term obligations.

Solvency Ratios

- Debt-to-Equity Ratio: Total debt divided by total equity.

- Interest Coverage Ratio: Operating income divided by interest expense.

Solvency ratios evaluate a company’s long-term financial health and ability to repay its debts.

6. Financial Projections and Forecasting

Income statement projections use historical data and assumptions to forecast future financial performance. Methods include trend analysis, regression analysis, and scenario planning.

Income statement projections help businesses plan for the future, make informed decisions, and manage risks.

Questions Often Asked: Prepare Income Statements For Both Garcon Company And Pepper Company.

What is the purpose of an income statement?

An income statement provides a summary of a company’s financial performance over a specific period, typically a quarter or a year. It presents a detailed breakdown of revenues, expenses, and profits, allowing stakeholders to evaluate the company’s financial position and make informed decisions.

What are the key components of an income statement?

The key components of an income statement include revenues, expenses, gross profit, operating profit, net income, and earnings per share.

How can I compare the financial performance of two companies?

To compare the financial performance of two companies, you can use a comparative income statement. This involves creating a side-by-side comparison of the income statements of the two companies over the same period, highlighting similarities and differences in revenues, expenses, and profitability.