Insurance serves as a vital mechanism for distributing financial burdens, safeguarding individuals from the potential consequences of unexpected events. By pooling risks and sharing the costs of losses, insurance spreads the financial burden of an individual’s loss to a larger group, ensuring that the impact of adversity is mitigated.

The principles of insurance, the role of insurance companies in risk assessment, and the importance of risk pooling and premium calculation form the cornerstone of this discussion.

1. Insurance Mechanisms for Distributing Financial Burden

Insurance operates on the fundamental principle of risk sharing, where individuals contribute premiums to a common pool, which is used to cover the financial losses of those who experience insured events. This mechanism spreads the financial burden of losses across a larger group, reducing the impact on any single individual.

Different types of insurance policies provide coverage for various risks, including property damage, liability, health expenses, and income loss. Insurance companies assess and underwrite risks by evaluating factors such as the probability and severity of potential losses, the applicant’s risk profile, and historical claims data.

2. Risk Pooling and Premium Calculation

Risk pooling is the foundation of insurance. By combining a large number of individuals into a pool, insurance companies can spread the financial burden of losses more evenly. This allows them to offer affordable premiums to policyholders.

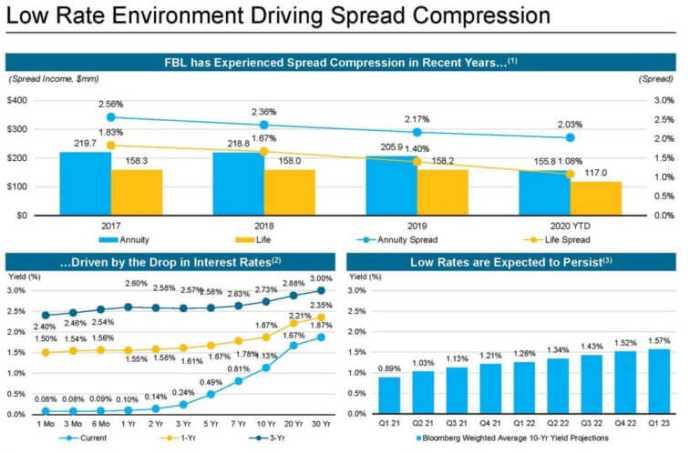

Insurance premiums are calculated based on actuarial science, which uses mathematical and statistical models to assess risks. Factors considered include the likelihood and severity of potential losses, the policyholder’s risk profile, and the overall claims history of the insurance pool.

Risk diversification is crucial for maintaining the stability of insurance pools. By insuring a diverse range of risks, insurance companies reduce the likelihood of catastrophic losses that could deplete the pool’s resources.

3. Claims Management and Loss Mitigation

When an insured event occurs, policyholders file claims to receive compensation for their losses. Insurance adjusters evaluate the claims and determine the amount of coverage that applies.

Insurance companies employ various strategies to mitigate losses and reduce the financial burden on policyholders. These include loss prevention programs, risk management techniques, and subrogation.

Loss prevention programs aim to prevent or reduce the likelihood of insured events occurring. Risk management techniques focus on minimizing the severity of losses when they do occur. Subrogation allows insurance companies to recover funds from third parties who are responsible for causing the loss.

4. Regulatory Framework and Consumer Protection

Government regulations play a vital role in the insurance industry. They ensure the solvency of insurance companies, protect consumer rights, and promote fair competition.

Transparency and disclosure are essential elements of consumer protection in insurance. Insurance contracts must clearly Artikel the terms and conditions of coverage, including the policyholder’s rights and responsibilities.

Individuals should carefully navigate the insurance landscape and make informed decisions about their coverage needs. By understanding the principles of insurance and their rights as consumers, they can ensure that they are adequately protected against financial risks.

Detailed FAQs: Insurance Spreads The Financial Burden Of An Individual’s Loss To

What is the fundamental principle of insurance?

Insurance operates on the principle of risk sharing, where individuals contribute to a common fund from which claims are paid in the event of a covered loss.

How do insurance companies assess risk?

Insurance companies employ actuarial science and risk assessment techniques to evaluate the likelihood and severity of potential losses, determining appropriate premium rates.

What is the importance of risk diversification in insurance?

Risk diversification is crucial for maintaining the stability of insurance pools, as it reduces the impact of any single loss event on the overall financial burden.