Computing wages accurately is essential for ensuring fair compensation and compliance with labor laws. The Computing Wages Worksheet Answer Key provides a comprehensive resource for employers and employees to verify their wage calculations, promoting transparency and accuracy in the payroll process.

This guide covers various aspects of wage computation, including different methods, factors influencing wage rates, and the impact of payroll taxes and deductions. By understanding these concepts and utilizing the answer key, individuals can ensure they receive accurate wages and make informed decisions regarding their compensation.

Computing Wages Worksheet

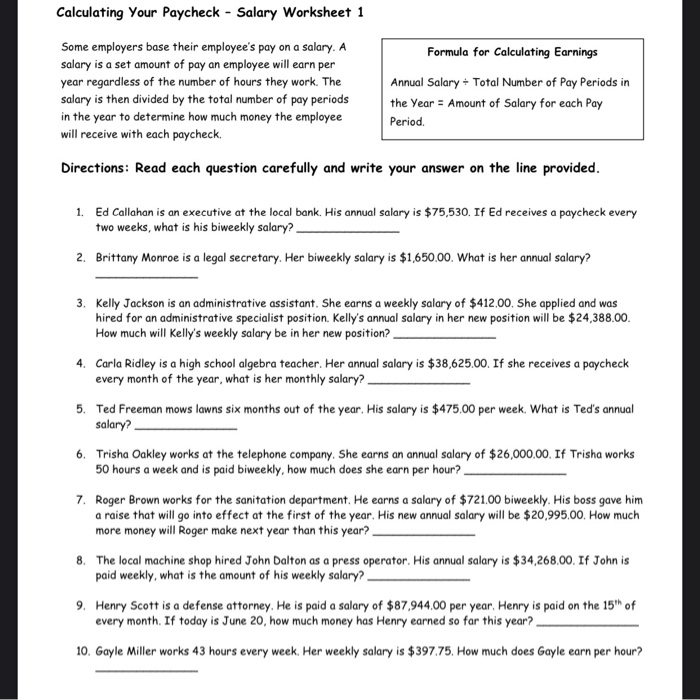

A computing wages worksheet is a tool used to calculate the wages of employees. It takes into account various factors such as hours worked, hourly rate, overtime pay, and deductions.

The worksheet helps employers ensure that their employees are being paid accurately and in compliance with labor laws. It also provides a record of employee wages for tax and payroll purposes.

Example of a Computing Wages Worksheet

A typical computing wages worksheet includes the following sections:

- Employee information: This section includes the employee’s name, employee ID, and pay period.

- Hours worked: This section records the number of hours worked by the employee during the pay period.

- Hourly rate: This section lists the employee’s hourly rate of pay.

- Overtime pay: This section calculates the amount of overtime pay earned by the employee, if any.

- Deductions: This section lists any deductions from the employee’s wages, such as taxes, health insurance premiums, and retirement contributions.

- Net pay: This section calculates the employee’s net pay, which is the amount of pay after all deductions have been taken out.

Benefits of Using a Computing Wages Worksheet

There are several benefits to using a computing wages worksheet, including:

- Accuracy: The worksheet helps ensure that employees are paid accurately by taking into account all relevant factors.

- Compliance: The worksheet helps employers comply with labor laws and regulations regarding wages and deductions.

- Record-keeping: The worksheet provides a record of employee wages for tax and payroll purposes.

- Efficiency: The worksheet streamlines the process of calculating wages, saving time and effort.

Answer Key for Computing Wages Worksheet

The answer key provided below is a valuable tool for checking the accuracy of your work when completing the computing wages worksheet. By comparing your answers to those in the key, you can identify any errors and make necessary corrections.

Accuracy is of utmost importance when completing a computing wages worksheet. Even minor errors can lead to significant discrepancies in the final wage calculation, potentially resulting in financial losses or legal issues. Therefore, it is essential to carefully follow the instructions provided on the worksheet and double-check your work using the answer key.

How to Use the Answer Key

To use the answer key, simply compare your answers to those provided in the key. If there are any discrepancies, review your work to identify the source of the error. Once you have corrected any errors, you can be confident that your wage calculation is accurate.

Methods for Computing Wages

Various methods are used to calculate wages, each with its own advantages and disadvantages. These methods include hourly wages, salaried wages, and commission-based wages.

Hourly Wages, Computing wages worksheet answer key

Hourly wages are calculated by multiplying the number of hours worked by the hourly rate. This method is commonly used for employees who work irregular hours or have unpredictable schedules. Hourly wages provide flexibility and allow employees to earn overtime pay when they work additional hours.

- Formula:Wage = Hours Worked × Hourly Rate

- Example:If an employee works 40 hours per week at an hourly rate of $15, their weekly wage is $600 (40 × $15).

Salaried Wages

Salaried wages are fixed amounts paid to employees on a regular basis, regardless of the number of hours worked. This method is typically used for employees who work consistent hours and have predictable schedules. Salaried wages provide stability and eliminate the need for overtime calculations.

- Formula:Wage = Annual Salary ÷ Number of Pay Periods

- Example:If an employee earns an annual salary of $50,000 and is paid bi-weekly, their bi-weekly wage is $1,923.08 ($50,000 ÷ 26).

Commission-Based Wages

Commission-based wages are calculated as a percentage of sales or services provided. This method is often used in sales and service industries where employees earn a base wage plus a commission for each sale or service they complete. Commission-based wages provide the potential for high earnings but can also be unpredictable.

- Formula:Wage = Base Wage + (Commission Rate × Sales or Services Value)

- Example:If an employee has a base wage of $1,000 and earns a 10% commission on sales, and they sell $5,000 worth of products, their wage for that period is $1,500 ($1,000 + (0.1 × $5,000)).

Factors Affecting Wage Rates

Wage rates are influenced by various factors, including experience, education, and location. These factors play a significant role in determining the amount of money an individual earns for their work.

Experience

Experience is a crucial factor that affects wage rates. Employers value individuals with proven experience in a particular field or industry. As employees gain more experience, they develop skills, knowledge, and expertise that make them more valuable to organizations. Consequently, experienced workers tend to command higher wages compared to those with less experience.

Education

Education is another important factor that influences wage rates. Employers often seek individuals with specific educational qualifications or degrees. A higher level of education, such as a bachelor’s or master’s degree, can significantly increase an individual’s earning potential. Education provides individuals with specialized knowledge, skills, and critical thinking abilities that are highly valued in the job market.

Location

Location also plays a role in determining wage rates. The cost of living in different geographic areas varies, and this can affect the wages offered by employers. In areas with a high cost of living, employers may need to offer higher wages to attract and retain qualified workers.

Conversely, in areas with a lower cost of living, employers may be able to pay lower wages while still attracting suitable candidates.

Payroll Taxes and Deductions: Computing Wages Worksheet Answer Key

Payroll taxes and deductions are amounts withheld from an employee’s gross pay before they receive their net pay. These withholdings are used to fund government programs and provide benefits to employees.Payroll taxes are mandatory contributions that are required by law.

The most common payroll taxes are:

- Federal income tax

- Social Security tax

- Medicare tax

Deductions are optional contributions that are made to employee benefit plans or other accounts. Some common deductions include:

- Health insurance premiums

- Retirement contributions

- Dependent care expenses

The amount of payroll taxes and deductions that are withheld from an employee’s pay depends on their income, filing status, and the amount of deductions they have elected to make.Payroll taxes and deductions can have a significant impact on an employee’s take-home pay.

The more taxes and deductions that are withheld, the less money an employee will receive in their paycheck.

Question & Answer Hub

What is the purpose of a computing wages worksheet?

A computing wages worksheet is a tool used to calculate wages accurately and efficiently. It helps employers determine the gross and net pay of their employees, considering factors such as hourly rates, overtime pay, and deductions.

How do I use the Computing Wages Worksheet Answer Key?

The answer key provides correct answers for the worksheet exercises. To use it, simply compare your calculated answers to those provided in the key. If your answers match, you have successfully computed the wages accurately.

What are the benefits of using a computing wages worksheet?

Using a computing wages worksheet offers several benefits, including increased accuracy, reduced errors, improved efficiency, and enhanced compliance with labor laws.